In early July, Japan set a premium price for solar energy

that was three times the rate of conventional power. This meant utility

companies would be paid three times more for electricity sourced from

solar. It's widely expected that the premium will ignite the use of

solar power -- and solar uses a lot of silver.

Silver Demand From PV Panels

As

you may know, silver is used in photovoltaic (PV) technology to

generate solar power. A typical solar panel uses a fair amount of the

metal -- roughly two-thirds of an ounce (20 grams). To put that in

perspective, a cellphone contains around 200 to 300 milligrams (a

milligram weighs about as much as a grain of sand). A laptop contains

750 milligrams to 1.25 grams.

Photovoltaic technology is

relatively young, but its use is growing rapidly each year. Just since

2000, the amount of silver consumed by solar-panel makers has risen an

average of 50% per year. Demand grew from one million ounces in 2002 to

60 million ounces in 2011. Last year demand from the PV industry

represented almost 11% of total industrial demand for the metal

(excluding jewelry). According to statistics from CPM Group, demand grew

by 11.2 million ounces, the strongest volume growth of all major

sources (jewelry and electronics). And this was before the Japanese

announcement was made.

(click image to enlarge)

The

largest end-user of solar panels is Germany, though that's changing.

Last year, Germany accounted for 27.3% of global installations, but due

to subsidy cuts, solar-panel installation capacity dropped from 7.7

gigawatts (GW) to 7.5GW. In the big picture, that decline was offset by

increases in China, France, Italy, the UK, Japan, and the U.S.

In their

2012 Yearbook,

CPM projected a slight decline in silver demand from solar panels due

to a reduction of new installation in Europe and oversupply from excess

production in China. But with the initiative from Japan, that estimate

is almost certainly low.

Japan Gives New Life To PV Industry

After

the Fukushima disaster, Japanese authorities wanted to cut the nation's

dependence on nuclear energy. Approximately 30% of Japan's power was

generated by nuclear before the catastrophe -- now the focus has shifted

to other green energy alternatives, including solar

.

The

new tariffs might work. The suggested rate of 42 JPY ($0.53) per

kilowatt hour (expected to be maintained for 20 years) is more than

twice the rate in Germany (€0.17, or $0.246). Bloomberg estimates that

this generous increase will create $9.6 billion investments in Japan

alone.

Here's what that amount of money would do to the sector:

There were approximately 1.3GW of solar capacity installed in 2011, but

experts anticipate that number to nearly double to 2.3-2.5GW for 2012,

and hit 3.0GW in 2013. According to SolarBuzz, Japan could see 28GW of

solar capacity installed by 2020 and 50GW by 2030.

That's a lot of solar panels, and -- even assuming improved efficiency -- it'll take a lot of silver.

Price Factors

During

recent years, solar panels have become significantly less expensive and

more end-user friendly. However, the fact that each panel contains a

lot of silver can make it susceptible to large price fluctuations. If

the silver price gets too high, manufacturers might seek alternatives,

of course, but they can't easily eliminate use of the metal. And if the

product gets too expensive, demand could fall. Companies are already

looking for ways to reduce the amount of silver used in PV panels, or to

replace it with another element.

At the moment, there are two

main solar panel technologies on the market. The traditional one is

"thick film," where silver is the main component. The other one is a

less-expensive "thin-film" method, which replaces silver with another

material, cadmium telluride. The development of thin-film solar panels

has picked up due to its lower price, but the technology is less

effective.

Thick film is more efficient in gathering energy from the

sun, and this type of panel still prevails on the market. CPM reports

that it accounted for roughly 91% of total installations last year, and

analysts expect thick-film panels to maintain their dominance for at

least the next several years. Further, both panel types use silver

outside of the cell for reflectivity and other functions, so the odds of

silver being eliminated from solar panels entirely are very low at this

time.

For investors, this means that at least in the near term,

the solar industry will continue to use silver-intensive technology,

thus supporting growing industrial demand for the metal.

But that's not all, folks…

New Era For Silver Usage

For

a long time, silver industrial demand was dependent almost entirely on

one industry: photography. Silver-based camera film dramatically changed

the structure of silver demand at the beginning of the 20th century. By

that time, silver had primarily been used in silverware, jewelry, and

as money. At its peak, photographic demand accounted for about 50% of

the market.

But this is the 21st century, and in spite of

substantial declines in film use, the modern world has developed many

other important uses from silver's unique properties.

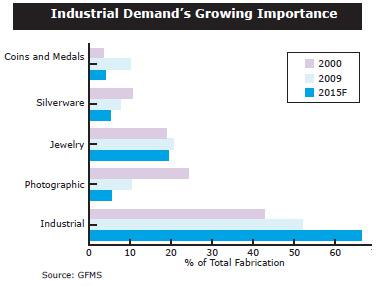

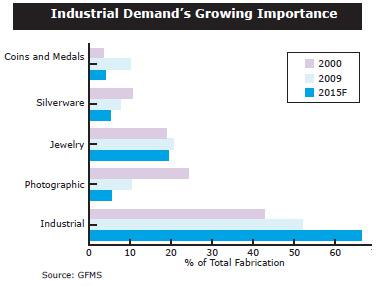

Probably

the most important shift is that industrial demand for silver no longer

comes from a single field, but from numerous applications -- almost too

many to count -- virtually none of which show any signs of slowing.

This fact makes the forecast for silver demand more positive and

stable. When one industry drops, others may offset the decline.

Here's a smattering of uses, many of which are still in their infancy:

- Solid-state

lighting (SSL), which uses semiconductors to produce light with either

light-emitting diodes (LED) or organic light-emitting diodes (OLED),

rather than the more traditional electrical filaments. SSL is used in

traffic lights and some car headlamps.

-

- Radio frequency

identification (RFID) uses printed silver ink made from silver nitrate.

RFID chips have become so ubiquitous, it's hard to find any new product

that doesn't have at least one -- even if that's only in the security

tag affixed to the package.

-

- Supercapacitors and superconductors, autocatalysts and new types of more effective batteries.

- Medical

applications, like aseptic coverings for surgery, traumatic wounds,

antibacterial bandages and fabrics, dental amalgam, and silver salts

that help prevent infections in newborns. It's also used to treat

dermatological problems and certain types of cancer.

- Water

purification systems, washing machines, air conditioners, and

refrigeration. NASA used silver to sterilize recycled water aboard the

space shuttle.

- Food packaging and preservation. Manufacturers of

commercial ice machines are using silver-embedded hoses, clamps, pipe

fittings, and in other places where gunk can build up and harbor

bacteria. Meat processors use silver-embedded tables, grinders, tools,

and hooks. Silver is used to keep fruit, vegetables, and cut flowers

fresh while in transit.

- Public hygiene, such as antimicrobial

protection of telephone receivers, door handles, bed rails, toilet

seats, counter tops, children's toys, socks, underwear, bed linen,

towels, etc.

- Other wide-ranging consumer products used every

day: makeup, antibacterial soaps and kitchenware, hand and air

sanitizers, and facial creams and masks.

Though the total

contribution from these new silver uses is relatively modest, the Silver

Institute rather dryly forecasts that "there is a potential for a

number of these segments to boost their silver consumption." As you can

see in the chart below, its forecast for silver demand for new

industrial uses projects that the biggest increases will be in

batteries, SSL, and RFID.

The

primary uses for silver are growing, too. For example, the automobile

industry is increasing consumption, due to both increases in the number

of vehicles manufactured and the expanded use of electrical contacts. As

the number of improvements in vehicles increase, so does the amount of

silver used. For example, silver is used to control seat and mirror

adjustments, windshield wipers, and manage navigation systems.

Based on their research, the

Silver Institute forecasts that industrial usage will rise to 665.9 million troy ounces by 2015, and account for more than 60% of total fabrication demand.

What It Means For Investors

What It Means For Investors

Since

half of silver demand is for industrial purposes, it can act like an

industrial metal in addition to its precious metal component. This means

it's susceptible to more forces than gold, making it more volatile, as

well as more difficult to predict its future price.

Conclusions:

- The

solar industry has great potential to become one of the more important

sources of silver demand. This will lend strong support to prices. This

industry had zero impact on silver 10 years ago; it now represents 10%

of total industrial demand.And it's not just Japan. According to a news report, 102 countries are now installing solar panels

-- from just 18 two years ago. Heavy and/or growing usage is reported

in Germany, Italy, Japan, France, Belgium, Portugal, Spain, the U.S.,

Australia, and Asia, including China and India.

- It appears

that the development of the solar industry didn't occur as a result of

natural forces, since to a large degree, it was initiated by government

subsidies that supported the industry (and indirectly, the silver

price). You may like or not like these market interventions, but as

investors, it's important to recognize these trends, regardless of

whether we agree with them. It's particularly important to keep an eye

on these subsidies, as they could vanish if cash-strapped governments

change their priorities. That won't happen overnight, however, so we

should have ample warning.

- Due to its unique properties, the

number of applications for silver continues to grow. Researchers at the

Silver Institute are upbeat about the future for silver industrial

demand. That's no surprise, but it doesn't make them wrong -- the

implication here is that only the worst type of economy would have a

negative impact on demand.

- If demand grows fast enough, it could

impact not only the price, but the availability of the metal, in spite

of rising mine production. If that happens, bullion purchase premiums

will rise as supply becomes tighter.

The bottom line on the

above is that the growing number of industrial applications for silver

represents a long-term shift in this market. Increasingly diverse usage

is not only here to stay, but will continue to grow, supporting the

price and impacting the balance of supply and demand.

For

investors, the thing to keep in mind is that while long-term prospects

for silver prices are extremely bullish, to the degree prices are driven

by this increased industrial demand, they are vulnerable to economic

correction/contraction in the short term.

Disclosure:

I have no positions in any stocks mentioned, and no plans to initiate

any positions within the next 72 hours. I wrote this article myself, and

it expresses my own opinions. I am not receiving compensation for it. I

have no business relationship with any company whose stock is mentioned

in this article.

View Source